kansas vehicle sales tax rate

For example in New York the state sales tax rate is 4 but county and local taxes can boost the rate up to 45 more. 75 hybrid fee 150 annual EV fee.

Kansas Car Registration Everything You Need To Know

There is a 20 mill statewide tax rate that is used to support education but the first 20000 in assessed.

. If you own multiple vehicles entering one of your plate numbers will retrieve all your vehicles and allow you to print your renewal notice. For additional information about Kansass sales tax regulations take a look at Kansass website. Plus 03 motor vehicle salesuse tax.

In other words you might pay a tax rate between 4 and 85 for the same car at the same sales price. Sales of services are generally exempt from. The good news is the Empire State limits its vehicle sales tax to a maximum of 725.

Enter Your Plate Number. Scroll to view the full table and click any category for more details. A mill levy is equal to 1 of taxes for every 1000 in assessed value.

72-155 based on weight. This page covers the most important aspects of Kansas sales tax with respects to vehicle purchases. So if your assessed value is 50000 and you have a mill levy of 30 your real estate taxes will total 1500.

Kansas tax rates are described in terms of mill levies. For vehicles that are being rented or leased see see taxation of leases and rentals. Depending on your locality the total tax rate can be as high as 85.

If you are interested in the sales tax on vehicle sales see the car sales tax page instead. 39-49depends on county NA. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

This table shows the taxability of various goods and services in Kansas. Below we list the state tax rate although your city or county government may add its own sales tax as well. Dept of Administration bid submission University of Kansas contract State employment Buyingselling business Local government bid submission Fort Hays States university contract Lottery Grantloan application License renewal ABC liquor license Vehicle dealer Angel investment credit transfer Insurance licensing.

Any new or increase in any state or local sales or use tax rate which tax or increase was not in effect on December 30 1987 on the sale storage use or consumption of aviation jet fuel at or upon airports within the state of Missouri which airports are recipients of federal grant funds have submitted applications for or have been approved. Official Website of the Kansas Department of Revenue. Reason for Tax Clearance request.

The Louisiana state sales tax rate is currently 445. Delivery of merchandise in New York in a taxpayer-owned vehicle.

Car Sales Tax In New York Getjerry Com

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Motor Vehicle Fees And Payment Options Johnson County Kansas

Missouri Car Sales Tax Calculator

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Sales Tax On Cars And Vehicles In Kansas

Kansas Car Registration Everything You Need To Know

Dmv Fees By State Usa Manual Car Registration Calculator

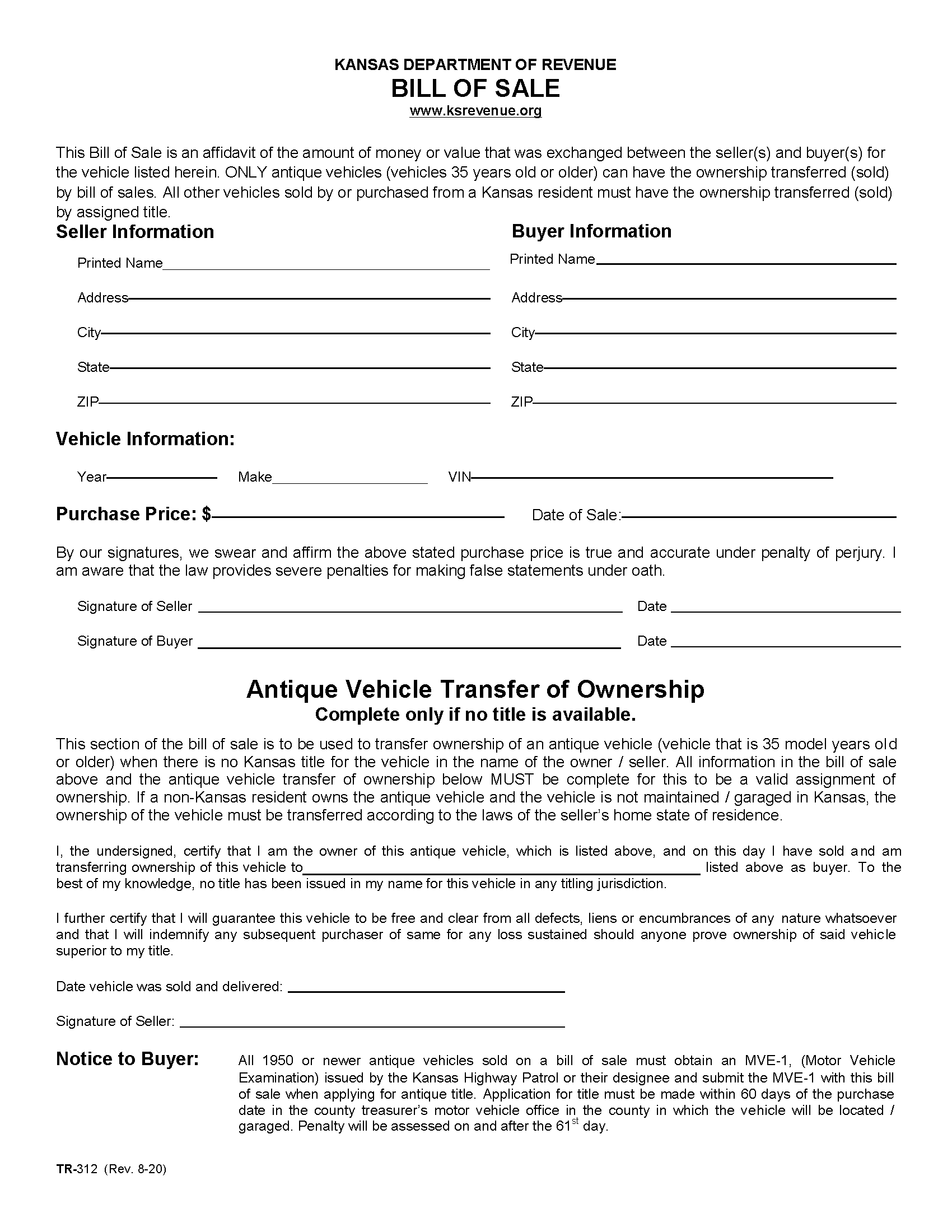

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Free Kansas Motor Vehicle Bill Of Sale Form Pdf Word

What S The Car Sales Tax In Each State Find The Best Car Price